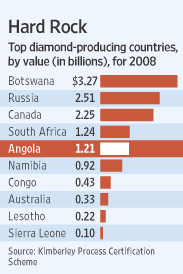

The Top Diamond Producing Countries:

An estimated 65% of the world’s diamonds come from African countries according to the Diamond Facts site.

An estimated 65% of the world’s diamonds come from African countries according to the Diamond Facts site.

Some of the Top Diamond Mining Companies are:

- De Beers

- Rio Tinto

- Alrosa

- Harry Winston Diamond

- BHP Billiton

- Petra Diamonds

- Gem Diamonds

Source: The ‘Blood Diamond’ Resurfaces,

The Wall Street Journal

----------------------

Diamond Price Guide

If you're on a very tight budget, you may wish to consider purchasing a gemstone (such as sapphire, ruby, tanzanite). Often you can get higher quality and larger stones for the same price you'd pay for a smaller, lower quality diamond.

- $125 - $500

This is the minimum you can expect to spend for a diamond engagement ring, and we do mean minimumCarat Weight: 0.15 - 0.25

Diamond Quality: Unknown (no AGS/GIA certificate)

Setting: 10-14K gold (white or yellow) - $500 - $750

Similar to the $125 - $500 range with slightly larger stones and the occasional 18K setting. In this price range, gemstones, rather than diamonds, are usually a better value.Carat Weight: 0.20 - 0.37

Diamond Quality: Unknown (no AGS/GIA certificate)

Setting: 10-14K gold (white or yellow); occasionally 18K gold - $750 - $1,000

This is the range where you start to see value for your diamond dollars. The stones are still on the small end of the scale, but you can find AGS/GIA certified stones (and thereby know the value of what you are buying). Additionally, you can find 18K gold settings and platinum settings.Carat Weight: 0.30 - 0.5

Diamond Quality: Varied.

Setting: 14-18K gold (white or yellow), Platinum - $1,000 - $2,000

High quality stones in the 0.30 - 0.57 range, mid- to high quality stones in the 0.58 - 0.75 range. AGS/GIA certified stones available, as well as 18K gold settings and platinum settings.Carat Weight: 0.30 - 0.75

Diamond Quality: Varied.

Setting: 14-18K gold (white or yellow), Platinum - $2,000 - $3,500

Absolutely exquisite quality diamonds in the low carat end of this range, but use caution when considering the larger stones. Make sure you are familiar with the "Four Cs" of diamond quality before purchasing. The 1-carat stones in this price range often have one or more of the following: visible inclusions (flaws), mediocre color quality ("faint yellow"), and/or a lower grade "cut" (which affects the "brilliance" of the diamond).Carat Weight: 0.40 - 1.00

Diamond Quality: Varied.

Setting: 14-18K gold (white or yellow), Platinum - $3,500 - $5,000

This is the lowest price range where you can reasonably expect to find some nice quality 1-carat stones. The smaller stones in this range will generally be of greater value and quality, but you can find some "lovely-to-the-eye" 1-carat diamonds.Carat Weight: 0.50 - 1.50

Diamond Quality: Varied.

Setting: 18K gold (white or yellow), Platinum - $5,000 - $7,500

Very nice quality diamonds in the low carat end (0.80 - 1.0) of this range, but use caution when considering the larger stones. Make sure you are familiar with the "Four Cs" of diamond quality before purchasing. The 2-carat stones in this price range often have one or more of the following: visible inclusions (flaws), mediocre color quality ("faint yellow"), and/or a lower grade "cut" (which affects the "brilliance" of the diamond).Carat Weight: 0.80 - 2.00

Diamond Quality: Varied.

Setting: 18K gold (white or yellow), Platinum - $7,500 - $10,000

You can find some spectacular diamonds in this price range -- big and beautiful. The best value is generally found in the 1.00 - 1.50 carat range. You'll find less spectacular, but still absolutely lovely diamonds in the 1.51 - 1.75 carat range. The 1.76 - 2.50 carat stones in this price range often have one or more of the following: visible inclusions (flaws), mediocre color quality ("faint yellow"), and/or a lower grade "cut" (which affects the "brilliance" of the diamond).Carat Weight: 1.00 - 2.50

Diamond Quality: Varied.

Setting: 18K gold (white or yellow), Platinum - $10,000 - $15,000

This is the lowest price range where you can reasonably expect to find some nice quality 2-carat stones (and the 1-carat stones in this price range will stir the heart of the toughest critic). The smaller stones in this range will generally be of greater value and quality, but you can find some "lovely-to-the-eye" 2-carat diamonds. The 2.20 - 3.00 carat stones in this price range often have one or more of the following: visible inclusions (flaws), mediocre color quality ("faint yellow"), and/or a lower grade "cut" (which affects the "brilliance" of the diamond).

NOTE: While you can expect to find a varied selection of up to 2.8 carat stones, greater carat weights are less abundant and you will have a relatively small number of diamonds from which to choose.Carat Weight: 1.00 - 3.00

Diamond Quality: Varied.

Setting: 18K gold (white or yellow), Platinum - $15,000 - $20,000

The one carat diamonds in this price range tend to be the "Best of the Best," and are generally diamonds with the highest possible grade in one or more of the following: color, cut, and clarity. You can also expect to find very nice quality stones up to 2.50 carats. The 2.51 - 3.00 carat stones in this price range often have one or more of the following: visible inclusions (flaws), mediocre color quality ("faint yellow"), and/or a lower grade "cut" (which affects the "brilliance" of the diamond).

NOTE: While you can expect to find a varied selection of up to 2.8 carat stones, greater carat weights are less abundant and you will have a relatively small number of diamonds from which to choose.Carat Weight: 1.00 - 3.00

Diamond Quality: Varied.

Setting: 18K gold (white or yellow), Platinum - $20,000 - $30,000

In this price range, you can expect to find excellent quality stones up to 2.80 carats. The 2.81 - 3.00 carat stones in this price range often have one or more of the following: visible inclusions (flaws), mediocre color quality ("faint yellow"), and/or a lower grade "cut" (which affects the "brilliance" of the diamond).

NOTE: While you can expect to find a varied selection of up to 2.8 carat stones, greater carat weights are less abundant and you will have a relatively small number of diamonds from which to choose in each price range.Carat Weight: 1.70 - 3.00

Diamond Quality: Varied.

Setting: 18K gold (white or yellow), Platinum - $30,000 - $60,000

In this price range, you can expect to find excellent quality stones up to 2.80 carats.

NOTE: While you can expect to find a varied selection of up to 2.8 carat stones, greater carat weights are less abundant and you will have a relatively small number of diamonds from which to choose in each price range.Carat Weight: 2.00 - 3.00

Diamond Quality: Varied.

Setting: 18K gold (white or yellow), Platinum - $60,000 and up

Diamonds in this price range tend to be greater than 3-carats (though not always) and will require a customized setting (standard settings generally accommodate up to three carats).

This guide is a general "diamond price guide," providing loose guidelines as to what type of diamond (size and quality) you can expect find within various price ranges. This price guide is not an official "diamond pricing index," but rather a general chart to retail diamond prices.

Diamonds used to be really expensive, but then diamond mines were discovered in South Africa in the late 1800s and prices plummeted. Thanks to the De Beers Group, a loose kind of cartel was formed to bolster prices.

De Beers has been an extremely effective cartel leader. Diamonds would probably sell for only a fraction of their current prices were it not for a combination of restriction of supply and a marketing campaign to increase demand.

The tradition of the diamond engagement ring is a bogus one. It's a tradition that De Beers invented in the 1930s. De Beers spent big money on marketing, and worked with Hollywood to place diamonds in romance movies.

The retail price of diamonds is two to three times the wholesale price, which in turn is quite a bit higher than what you would get paid if you wanted to sell back your diamond - ever tried to sell back diamonds to the shop? In this instance gold jewelry are a lot better. And probably the wholesale price is several times higher than what it would be without a cartel to prop up the prices. (De Beers has successfully convinced people not to sell back their diamonds with its "diamonds are forever" campaign--if people sold back their diamonds instead of keeping them as family heirlooms, this would put downward pressure on prices.)

Who decided that a man should spend two to three months of his salary on an engagement ring? De Beers. If only all the men of the world would unite and agree not to pay so much, we would all be better off.

A combination of new supply from Canada and Russia, as well as the development of lab-created diamonds indistinguishable from the real thing, threatens to cause a huge crash in the price of diamonds. This is yet another warning against spending two months of salary on a diamond; ten years from now that same diamond may sell for only one week of salary.

Now, try to convince your wife or girlfriends of that ; )

![[Aum+Patcharapa.jpg]](http://2.bp.blogspot.com/_Rxo-dVWeH5A/Rr7orW88gzI/AAAAAAAAApQ/N3M-bYj1G30/s1600/Aum%2BPatcharapa.jpg)

![[Aum+Patcharapa+2.jpg]](http://2.bp.blogspot.com/_Rxo-dVWeH5A/Rr7orW88g0I/AAAAAAAAApY/H1DJGelAzn4/s1600/Aum%2BPatcharapa%2B2.jpg)

![[Aum+Patcharapa+3.jpg]](http://3.bp.blogspot.com/_Rxo-dVWeH5A/Rr7orm88g1I/AAAAAAAAApg/sDmGWzPJXKI/s1600/Aum%2BPatcharapa%2B3.jpg)