The UN Secretary-General Ban Ki-moon on Wednesday approved a statement reached by the UN Security Council members that condemned the use of force against civilians in Libya.

BAN KI-MOON, UN SECRETARY-GENERAL:

"The situation is developing rapidly, toward a very dangerous situation. Therefore, we need to very carefully monitor the situation. I will continue to urge, in the strongest possible terms, first to stop violence, to protect human rights and the civilian population.“ Ban also called on Libyan authorities to address the demands of the Libyan people.

The U.S. President Barack Obama described the violence in Libya as "outrageous" and "unacceptable".

BARACK OBAMA, US PRESIDENT:

"I've also asked my administration to prepare the full range of options that we have to respond to this crisis. This includes those actions we may take and those we will coordinate with our allies and partners or those that we'll carry out through multilateral institutions."

Meanwhile, governments around the world are sending planes and ships to evacuate their citizens from Libya.

Fears for the safety of foreigners were heightened after a Turkish worker was shot dead in a construction site near the capital Tripoli on Wednesday. Turkey, European Union states, the U.S. and China, among other countries, are picking up their citizens stranded in Libya by air and sea.

The spreading violence in Libya has also caused anxiety in markets. The U.S. crude oil price briefly crossed 100 dollars a barrel on Wednesday, hitting the triple digits for the first time since October 2008. Reports say one-fourth of Libya's oil producing capacity has been affected. Oil firms operating in Libya are suspending production and evacuating workers. Investors, fearing that higher energy prices will hit corporate profits, also avoided stocks. The price of gold, a traditional safe haven in times of trouble, also soared.

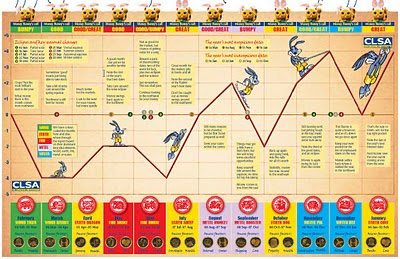

: Marsha Londoh/CD Album We should expect a greater concerted effort in terms of embargo from major countries to put pressure on Libya. The more actions are taken, only then would we see pushing the events to some sort of conclusion.What is interesting is the level where VIX is at over the last few days. While it did jump to 24 from a benign 16, it did not scale further. In fact it very quickly dip back to 20, which is not a serious risk aversion thing. This points to the fact that not many are scrambling to hedge their long positions, which also translate to the fact that investors are generally willing to go long or buy more, and not the other way around. The way VIX traded would tell me that we are in for a very short period of down days. The way the VIX traded would tell me that we are in for a speedy resolution in Libya. My thinking is that Gadaffi should be out very soon, I think the delay is him negotiating his exile terms (i.e. not to be persecuted and be left with his millions or billions in peace) ... hah ...

Gold is steady and higher. To me the commodity is way over-owned at levels above 1,400. Smart money should be halving their gold holdings now. Its only logical, we need to ask ourselves, is Libyan crisis affecting the price of oil - the answer is yes. If that is a yes, will the US and/or Europe going to allow their feeble economies to be drastically affected by that? You know the answer to that as well. Hence, be it Obama or Bush, the US will one way or another ensure that the Libyan oil wells keep functioning, or else.

Warren Buffett is going long on America, and investors are likely to take note when markets open on Monday. Buffett's annual letter, released Saturday, is brimming with references to the strength of the American people, economy and spirit. Investors said they were struck by how confident the letter was, particularly in comparison to his annual missives of recent years.

"Money will always flow toward opportunity, and there is an abundance of that in America," said Buffett, who has run Omaha, Nebraska-based Berkshire Hathaway since 1965 and is now one of the world's richest men.

"The prophets of doom have overlooked the all-important factor that is certain: Human potential is far from exhausted, and the American system for unleashing that potential ... remains alive and effective."

He also forecast a recovery in the housing market "within a year or so" and that "America's best days lie ahead."

Given that Buffett owns the entirety or a large share of the country's largest railroads, insurers, banks, consumer products makers and distributors, his optimism could be seen as an endorsement of the economy in 2011 and beyond.

I have laid out what I consider to be prime factors in assessing risk at the present time, you do your own conclusions.